Money supply: M0, M1, and M2

Our

web

site is scanned on a regular basis for security holes and known vulnerabilities in order to make your visit to our site as safe as possible. We use regular malware scanning.

Your personal information is contained behind secured networks and is only accessible by a limited number of persons who have special access rights to such systems, and are required to keep the information confidential. In addition, all sensitive/credit information you supply is encrypted via secure socket layer (ssl) technology. We implement a variety of security measures when a user places an order enters, submits, or accesses their information to maintain the safety of your personal information. All transactions are processed through a gateway provider and are not stored or processed on our servers.

Your personal information is contained behind secured networks and is only accessible by a limited number of persons who have special access rights to such systems, and are required to keep the information confidential. In addition, all sensitive/credit information you supply is encrypted via secure socket layer (ssl) technology. We implement a variety of security measures when a user places an order enters, submits, or accesses their information to maintain the safety of your personal information. All transactions are processed through a gateway provider and are not stored or processed on our servers.

The us federal reserve board measures the money supply using the follow ing measures.

The u. S. Money supply comprises all of the physical cash in circulation throughout the nation, as well as the money held in checking account s and savings accounts. It does not include other forms of wealth, such as long-term investments, home equity, or physical assets that must be sold to convert to cash. It also does not include various forms of credit, such as loans, mortgages, and credit cards.

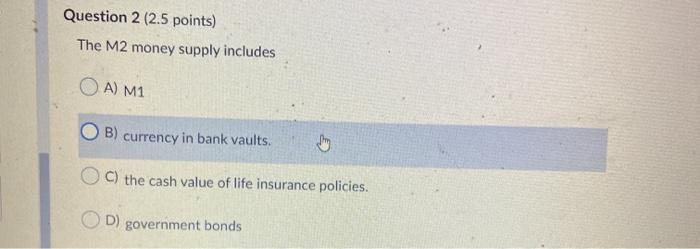

M1, m2 and m3 are measurements of the united states money supply, known as the money aggregates. M1 includes money in circulation plus checkable deposits in banks. M2 includes m1 plus savings deposits (less than $100,000) and money market mutual funds. M3 includes m2 plus large time deposits in banks. ← return to glossary.

What is m2 today?

Milton

friedman was touring india, and while there he shocked his audience by stating, “inflation is always and everywhere a monetary phenomenon. ” this was 1963, and the audacity of that statement is today understated. Back then, keynes didn’t just rule there was hardly any opposition to such accepted orthodox dogma.

Equipment financing makes economic and practical sense compared to other alternatives and m2 understands equipment. It's only logical that a company dedicated exclusively to providing equipment financing would be a wise choice to use for your capital equipment financing needs. Today, equipment finance structures have come a long way and deliver the flexibility equipment users demand. You run your business, we'll provide the equipment financing. It's a partnership that works.

The m2 monsters are coming to our world. Find out how this asset backed nft can help to bring change to the financial world today. Discover where the latest sightings are and what you need to know about m2 cash, and social bees university. Watch these m2 monsters videos to see why this could be the biggest nft project in 2022. Learn more about m2 monsters m2monsters. Io.

Most va loans are “assumable,” which means you can transfer your va loan to a future home buyer if that person is also va-eligible. Assumable loans can be a huge benefit when you sell your home — especially in a rising mortgage rate environment. If your home loan has today’s low rate and market rates rise in the future, the assumption features of your va become even more valuable.

Are m1 and m2 really money?

Before may 2020, m2 consists of m1 plus (1) savings deposits (including money market deposit accounts); (2) small-denomination time deposits (time deposits in amounts of less than $100,000) less individual retirement account (ira) and keogh balances at depository institutions; and (3) balances in retail money market funds (mmfs) less ira and keogh balances at mmfs. Beginning may 2020, m2 consists of m1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less ira and keogh balances at depository institutions; and (2) balances in retail mmfs less ira and keogh balances at mmfs. Seasonally adjusted m2 is constructed by summing savings deposits (before may 2020), small-denomination time deposits, and retail mmfs, each seasonally adjusted separately, and adding this result to seasonally adjusted m1.

“money” actually includes various forms of payment—not just coins, bills, credit, and checks. This datapost tutorial walks through the various types of payment that contribute to our notion of “money” in the united states. Download presentation slides (pdf, 614 kb).

Pass our greenlight guaranteed practice exam & we guarantee you’ll pass your exam – or your money back!*.

Cash in your pocket certainly serves as money; however, what about checks or credit cards? are they money, too? rather than trying to state a single way of measuring money, economists offer broader definitions of money based on liquidity. Liquidity refers to how quickly you can use a financial asset to buy a good or service. For example, cash is very liquid. You can use your $10 bill easily to buy a hamburger at lunchtime. However, $10 that you have in your savings account is not so easy to use. You must go to the bank or atm machine and withdraw that cash to buy your lunch.

What is m1 m2 m3 in money supply?

China records higher new loans, slower m2 expansion in h1 chinese banks extended 7. 97 trillion yuan (about 1. 2 trillion u. S. Dollars) of new yuan-denominated lending in the first half of the year, but broad money supply growth has continued a downward trend, the country's central bank said wednesday. The lending volume represents growth of 436 billion yuan from the same period last year, the people's bank of china said in a statement. By the end of june, total outstanding yuan-denominated loans stood at 115 trillion yuan, up 12. 9 percent year on year. In june alone, a total of 1.

What is m1 m2 and m3 money?

Because m1 is part of m2, m2 is always m1 (except in the rare case where time deposits and money market funds = 0, in which case m1 = m2). That fact is reflected in the inclusion of the time deposit and money market fund ratios in the numerator of the m2 multiplier equation. Moreover, no reserves are required for time and money market funds, so they will have more multiple expansion than checkable deposits will. The required reserve ratio, the excess reserve ratio, and the currency ratio appear in the denominator of the m1 and m2 money multipliers because all three slow the multiple deposit creation process.

Comments

Post a Comment