Why Back NFTs Using Physical Assets?

At this point, if you're unfamiliar with the concept of

nfts

, you've missed out on several news cycles. But if you've heard of them and still find them confusing, you're not alone. Nfts, or nonfungible tokens, are tokens representing the purchase of an asset on the blockchain, serving as a digital receipt for the purchase.

Over the past few years, nfts have begun to be adopted across multiple industries, evolving to fit increasing demand regarding their integration into consumer markets and becoming one of the most disruptive innovations in recent memory. However, their full potential as a new class of digital assets remains to be seen, including the possibility of minting a physical product into an nft.

The underlying concept is simple: instead of a commodity (like gold) being backed by actual commodities (like real estate), asset-backed tokens are backed by digital assets (like digital currency). If you think about it, this makes sense because the currency is not physical but merely an idea. Just like an iou is not backed by anything tangible, an unsecured piece of digital currency does not have any tangible physical connection to any particular commodity. The next logical step following the adoption of asset-backed tokens on the part of the general public is for private investors and businesses to adopt the same technology and use it for themselves.

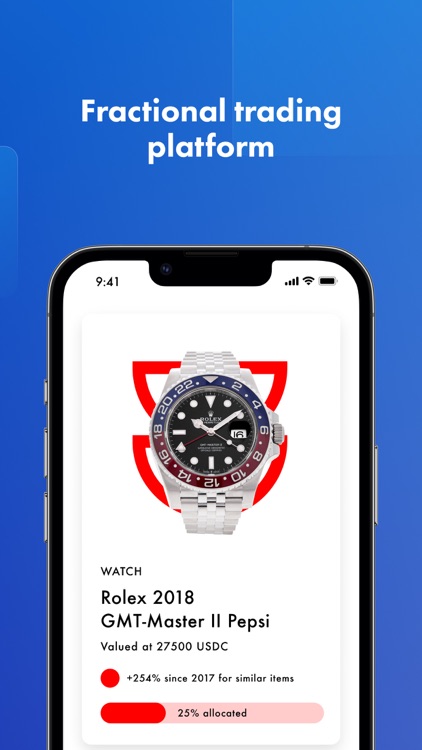

Troika’s nft marketplace, redeeem nft will use nfts to redeem physical rare luxury goods los angeles, ca - ( newmediawire ) - february 18, 2022 - troika media group (nasdaq:trka), through its subsidiary, troika io, has become the first publicly-traded company to use the bitcoin ledger to secure its non-fungible tokens (nfts) backed by luxury brands. With more fashion and luxury brands looking to capitalize on nfts and crypto offerings, troika io will provide a new way for brands to list luxury assets tied to nfts using a familiar asset such as bitcoin. Troika’s nft marketplace, redeeem nft, serves as a marketplace for luxury asset-backed nfts and lists a number of rare luxury goods including handbags and wallets, shoes and accessories, and collectable art pieces.

How can NFTs be Used for Luxury Assets?

Increasingly, companies in the consumer sector are entering new

market

s by leveraging the unique opportunities that non-fungible tokens (nfts) have to offer. These one-of-a-kind digital tokens, backed by blockchain technology, give brands the opportunity to sell:

tokenised products that are entirely digital in nature (digitally native nfts); and

tokens that are tethered to real-world assets (real-world asset backed nfts). Recently, herbert smith freehills advised treasury wine estates (twe) on the sale of a rare penfolds magill cellar 3 barrel of wine to be traded through nfts on the blockbar blockchain platform, an nft marketplace for luxury wine and spirits. The barrel nft will be converted to 300 bottle nfts which will be uniquely tethered to real-world wine bottles.

This Week in Useful Tokens

By hayes brown , msnbc opinion columnist as far as shocking news goes, if this week’s leaked draft from the supreme court was a 10, then the wall street journal declaring that “ the nft market is collapsing ” is maybe — maybe! — a three. The idea behind non fungible tokens is both simple and revolutionary: their purchase history is permanently logged in the blockchain. (please just watch this video explaining the blockchain , also embedded below, instead of making me have to do it, thank you. ) each link in the chain is uniquely generated, requiring a sizable amount of energy for the computations involved and offering a near tamper-proof chain of custody.

The internet of assets

A token is a digital asset backed by a cryptocurrencies blockchain. So what does that mean exactly? a token is a representation of a store of value. In traditional finance, a token looks like a coin. In the crypto community , it’s a tradeable asset on the blockchain. Tokens are assets that can grant access to communities and digital files and can be publicly traced and verified, making them nearly impossible to be copied and shared. The first wave of the internet focused on digitizing the world. The next phase is focused on tokenizing it.

How do NFTs work?

Nfts, or non-fungible tokens, are an emerging digital asset class that have captured the attention of consumers and investors alike. Although the technology that makes nfts possible has been around for several years, nfts have very much emerged into public consciousness in 2021. Celebrities, creators, and athletes are investing in nft technology and exploring ways to commercialize their brand, image, or work through issuing nfts. While this asset class is in its nascent stages, the legal and regulatory issues they present are very real. Below we briefly describe nfts and some of the most relevant u. S. Legal issues.

This time last year we were just getting used to the term nfts and within a span of one year they are ruling the world. The industry has been growing at a tremendous rate and there is no stopping that. With the amount of time that we all spend online, no wonder the nfts have picked up such a fast pace. It is widely accepted that we all have a parallel digital identity and nfts will be a big part of this identity through its uniqueness. Nfts tend to represent a valuable unique moment in history and culture. They are unique cryptographic tokens that exist on a blockchain and cannot be duplicated.

Comments

Post a Comment